Interview: Jim McNulty’s Workforce Housing Down Payment Assistance Proposal

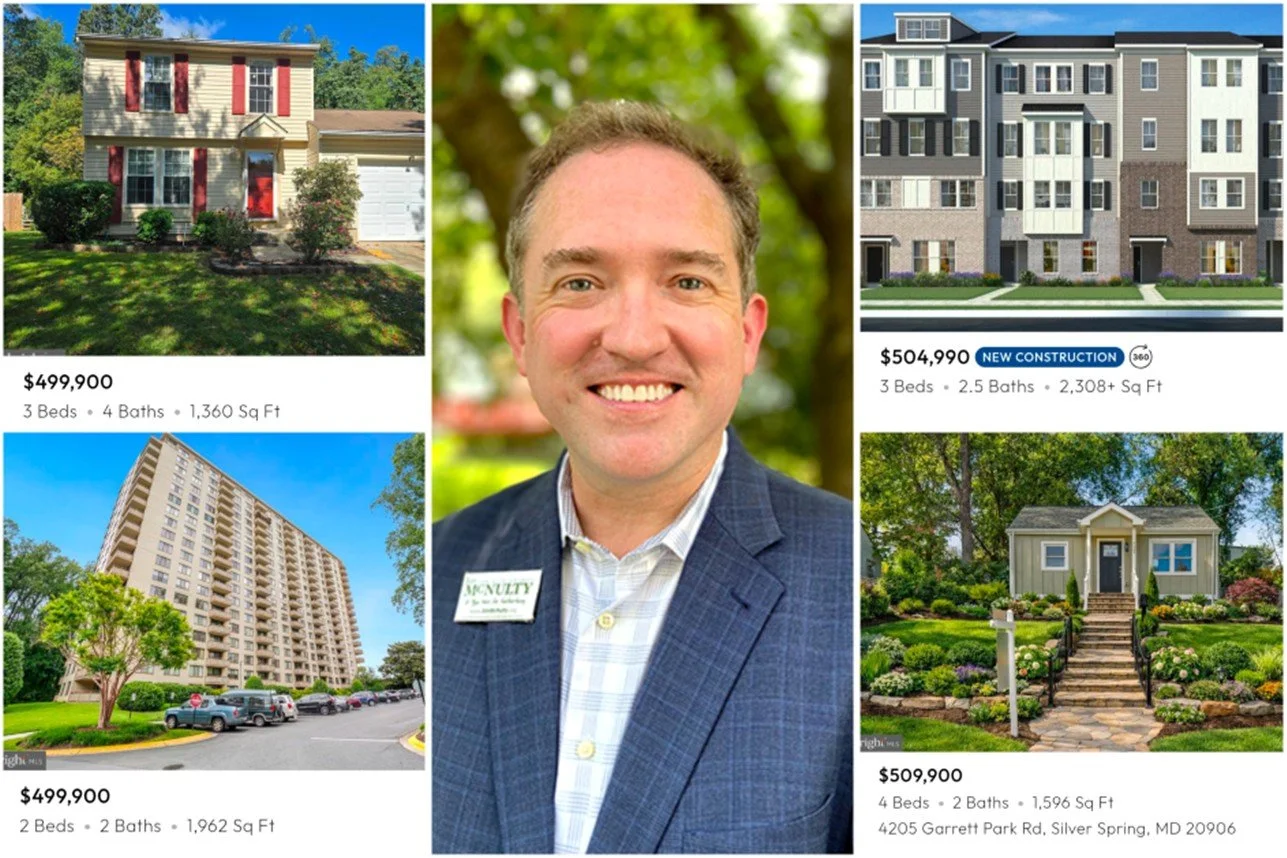

Photo Montage: center, Jim McNulty from campaign website; sides, screenshots from Homes.com taken 2/2/2026

At-Large Montgomery County Council candidate Jim McNulty has proposed a countywide workforce housing down payment assistance fund aimed at helping long-term renters and essential workers purchase their first homes. The proposal would expand a model currently used by the City of Gaithersburg, providing up to $40,000 in down payment loans to about 100 qualifying households per year (1,000 over the first 10 years). It would be funded through a mix of housing bonds and recordation tax revenue.

Montgomery Fix spoke with McNulty on February 2, 2026, in an extended interview focused on the mechanics of the proposal, its fiscal risks, and criticisms that it prioritizes buyer subsidies over housing production. The interview is presented below, with quotes lightly edited for clarity while preserving meaning and context, and ellipses (...) indicating minor jumps for brevity.

Demand, Supply, and Price Pressure

MONTGOMERY FIX: Your proposal injects public money into buyers’ pockets in a market with limited starter-home supply. What evidence do you have that this won’t simply increase bidding pressure and raise prices, especially for moderately priced homes?

MCNULTY: It’s a good question. So much of what we’re dealing with, with affordability, is supply and demand. And what we’re seeing—particularly in these starter-home price ranges—is that people are struggling to be able to come up with that down payment.

The difference in a monthly payment between a $500,000 home versus a $550,000 home is not as much as people might think. The monthly payment really is less of an obstacle. It’s the down payment.

That’s why I proposed expanding what we’re doing in Gaithersburg through the county. We’re talking about a thousand working families in the first ten years of the program. That’s about a hundred a year across the entire county. So I don’t see that we are going to be jacking up the entire county’s costs of purchase through this program. We haven’t seen that in Gaithersburg. But even for argument’s sake, let’s say we did see some uptick because it lights a fire in the market. Then we’re increasing the amount of recordation taxes the county receives, assessments continue to go up, and that brings in more revenue. We’re in a situation right now where we’re concerned about county revenues and we don’t want to be raising property tax rates. Anything that stimulates our economy and gets things going is good for all of us.

Buyer Assistance vs. Building Housing

MONTGOMERY FIX: Your plan doesn’t directly create new housing. Why prioritize buyer subsidies over zoning reform or supply-side solutions?

MCNULTY: I’m not saying it’s either-or. What I’m saying is this is one of the things I hear from renters: they don’t feel like they ever have a chance to get a home. There’s been so much focus on rent control because of trying to control monthly costs. But getting yourself into your own home and having a 30-year mortgage is one way to create cost certainty.

And the obstacle to getting there for many folks is that down payment. I’m not saying zoning reform isn’t something we should pursue. I’m not saying revisiting the rent control situation isn’t something we should look at. But this is one lever we can push right now.

If you look at where we can add housing at scale—Lakeforest, White Flint, the Comsat property, Viva White Oak—those are incredibly important. But adding this down payment assistance program on top of adding new inventory is going to allow longtime renters, some of our first responders and teachers, to be able to afford where they live...We need some of these bigger developments... But adding this... is going to allow some of these longtime renters... to be able to afford where they live. And whether it’s through building missing middle two over twos and other types of housing stock... we need to do a lot of different things. Being a realtor and seeing what’s working now, I’m not trying to reinvent the wheel. I’m trying to expand something that has shown it can be beneficial.

Housing Quality and Financial Risk for Buyers

MONTGOMERY FIX: Homes around $500,000 in Montgomery County often need serious work. Are you concerned that this program could put families into homes they can’t afford to maintain?

MCNULTY: The down payment assistance program would be available to somebody that’s eligible for an FHA loan. So, they still have to have the credit score, they still have to have the income, and they still have to meet the debt-to-income ratios. We’re not talking about handing somebody a sack of cash and saying, ‘Good luck.’ One of the requirements of an FHA loan is that you have to take a class on homeownership, including understanding the need for a rainy-day fund. The government’s not qualifying the individual. The lender is. If they don’t qualify for the mortgage, they don’t qualify for the program.

Income Limits and Affordability

MONTGOMERY FIX: Your proposal allows eligibility up to about 120% of area median income, roughly $157,000. Critics say that stretches the definition of affordability.

MCNULTY: If we had unlimited resources, we would help as many people as humanly possible, right? This is a specific program aimed at removing a specific barrier. When you move folks from rental into homeownership, you’re opening up rental inventory for other folks. You’re reducing demand in the rental market, and that helps stabilize rents. There are other programs for other groups. This one is targeted at workforce housing.

Priority Groups and Equity Concerns

MONTGOMERY FIX: You emphasize public servants like teachers and police officers. What about other workers, like retail employees or tradespeople, who are also essential to the county?

MCNULTY: This isn’t excluding longtime renters. Renters who’ve been in the county for three years or more are part of the priority group. But we do have real retention problems with police and teachers, and it’s becoming more difficult for them to stay here. That’s part of why I’m highlighting those groups. You’ve got a family of four who’s been renting for 10 years and they’re paying three grand a month. They just can’t get the down payments together. This is meant to be that head start. And these aren’t grants, right? They’re loans. So, they will be paid back at some point.

Recordation Taxes, Bonds, and Trade-Offs

MONTGOMERY FIX: You propose using recordation tax revenue to fund the program, or at least parts of it. With no new housing stock coming into the system through your proposal specifically, what programs or services wouldn't receive those dollars as a result, and why would that be a better use of those funds?

MCNULTY: It's a very good question. We are going to need to make some very difficult choices this next council. We need to take really a wholesale look at how our government is situated and look for opportunities to remove some of the bureaucracy. We may need to pause certain programs to focus on things that we can invest in to get our economy going, that can then begin to lift us up. This will be one of those mechanisms that can get the economy going …so that we can encourage investment in Montgomery County. We're going to need to triage where our focus should be, where can we reorganize and where can we delay, so that we can invest money now and plant these seeds that result in future growth.

I'm not advocating that we reduce important services. Food insecurity is a huge issue right now. Our unhoused population is continuing to climb. We need to be looking at our focus…And I think recently the focus has not always been in the right place.

One of the additional ways that I'm suggesting that we pay for this program is through housing bonds. Of course there will be debt service that is part of it, but we'll need to make choices. And that's going to be a lot of the hard work that's going to be coming ahead; making sure that we are living within our means, but still providing excellent services to the community.

Risk, Repayment, and Taxpayer Exposure

MONTGOMERY FIX: What happens if repayment assumptions fall short? Don’t tax payers bear the risk?

MCNULTY: Based on FHA loans historically, you’re looking at about a one to two percent foreclosure rate. Part of what we would be doing... is a one or 2% origination fee, which helps to pay for some of the administration of the program. Is there a risk? Yes, but based on crunching some numbers, it should not exceed that. As we sit down to make the law, we want to make sure that we'll be protecting ourselves as best as possible. And in some of these areas there are never guarantees anywhere. If these were all grants, none of it would be paid back. So, we're trying to set up a program for as best success as possible. And the reaction so far has been really positive. I've had other elected officials, other candidates…folks on social media, thanking me for this idea, which again is… something that we're doing successfully in Gaithersburg.

Self-Sustaining Claims

MONTGOMERY FIX: You’ve said the program could become self-sustaining after about 10 years. What assumptions are behind that?

MCNULTY: It’s based on average repayment timelines. Historically, people refinance or sell in about five to seven years. Once you have enough loans in the system, repayments start feeding back into the fund. Gaithersburg has been doing this for more than 15 years.

[McNulty noted Gaithersburg isn't fully self-sustaining yet due to its smaller scale.]

We’re getting some back, but we’re not at a point where we’re seeing the large amounts coming back yet... we’re also not doing a thousand loans a year.

Rental Market Ripple Effects

MONTGOMERY FIX: By helping a thousand households buy homes, that’ll free up a thousand rental units. But do those units become more affordable, or simply re-rent at higher prices?

MCNULTY: The market’s going to determine what the rate is. Whether that’s offered at the same, whether that reduces the demand in certain areas, that’s hard to forecast. Right now, rents have been relatively stable, but it really depends on where folks are moving from, what the demand is in that particular neighborhood at a given time, and what else is available at that time too.

Fairness and Cutoffs

MONTGOMERY FIX: How do you justify sharp eligibility cutoffs that exclude people in nearly identical situations?

MCNULTY: A line has to be drawn somewhere. Lenders do this all the time. FHA does it. MPDUs do it. Nobody likes being on the wrong side of an imaginary line, but the line still has to exist.

Real Estate Incentives and Motives

MONTGOMERY FIX: How do you respond to critics who say this plan stimulates real-estate turnover more than lasting affordability—and that as a realtor, you benefit indirectly?

MCNULTY: I expect that anytime you have an expertise in an area and you're talking about it, you're going to get those kinds of questions. I'm not benefiting from the program. I just happen to have an expertise in real estate. I also have expertise in marketing and being in television. We have lawyers on the Council approving things that are in their sphere… Because I'm a realtor, I see the need and the solution, and I am running to put myself in positions where I can help, where I see opportunities. This is an obstacle to home ownership, and that's why I'm pushing in this direction.

# # #

Publisher’s Note: To read Jim McNulty’s full proposal, visit the Blog section of his campaign website.